The Dividend Guy HAS Moved

Please direct your browser and all bookmarks to:

The Dividend Guy (http://www.thedividendguyblog.com)

Thank you for your patience. See you at the new spot!!

One average guys journey to investment income through investing in dividend paying investments.

Please direct your browser and all bookmarks to:

I am having so much fun at this blogging thing that I decided to move my site to a new hosting site and use WordPress as my blog platform. I hope it goes well...seems a bit complicated to move stuff over but we shall see. The new link will be here:

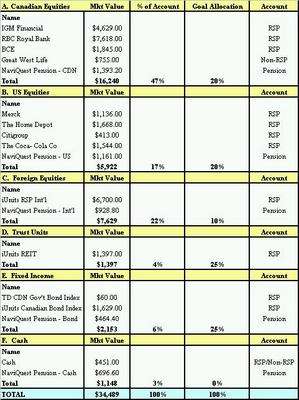

Asset allocation is a tool that investors can use to help reduce the risk in their portfolio. The thinking is that, as not all investment types move in the same direction at the same time, you can "cover your bets" by investing in a few different investment types to take advantage of the various moves each class can take.

How did I come up with this allocation? I started by deciding how much I wanted to have in equities and worked from there. I used the rough calculation of 100 minus my age (100 - 31 = 69%) as a start. I include Trust Units as an equity component as opposed to Fixed Income as it is not fixed income in the same manner as government bonds are - trusts hold much more risk. In addition, I am low on cash which will limit my ability to purchase if the market crashes.

How did I come up with this allocation? I started by deciding how much I wanted to have in equities and worked from there. I used the rough calculation of 100 minus my age (100 - 31 = 69%) as a start. I include Trust Units as an equity component as opposed to Fixed Income as it is not fixed income in the same manner as government bonds are - trusts hold much more risk. In addition, I am low on cash which will limit my ability to purchase if the market crashes.In Canada, we are in the "off-season" for advertisements from investment companies selling us their investment options. However, no matter when the advertisements are on, investors need to be very careful not to get swayed by the aggressive advertising tactics of these companies. I came across a list of things that investors should keep in mind when viewing advertisements about investments. Here is the list:

I updated my Microsoft Money file today, as I usually do once or twice a week and my portfolio has done well. The last time I updated the information on this blog was August 22nd. At that time my portfolio was valued at $33,996. Today I am showing a value of $34,489 - an increase of $493 since August 22nd. This is not all investment gain as I have contributed some money to both my pension and RSP.

Any investor, if they have been investing long enough, has made at least one dumb investment. I have made a few, that is for sure.

First off, a big thank you to Chad at "Twenty Something Finance" and farhan for their comments in relation to the post on my investing principles. To provide some background to those of you who did not read the comments, their questions were concerning my rule that I avoid mutual funds in my portfolio. Farhan asked why I avoid funds since some index funds also have low MERs. Chad did not agree with me that mutual funds should be avoided, and made the case that the MERs are a small price to pay for the time fund managers spend seeking out opportunistic investments and that they have quicker access to information than the average investor. He mentioned that he has been successful (i.e. beat the benchmark) with his strategy over the past five years.

I hate to sell stocks that I own. Why? One of two reasons: