Dividend Investing - Asset Allocation

Asset allocation is a tool that investors can use to help reduce the risk in their portfolio. The thinking is that, as not all investment types move in the same direction at the same time, you can "cover your bets" by investing in a few different investment types to take advantage of the various moves each class can take.

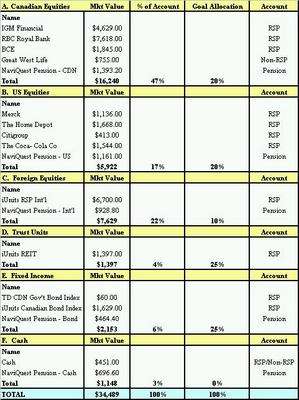

I break my asset allocation into 6 different asset types:

- Canadian Equities

- US Equities

- Foreign Equities

- Trust Units

- Fixed Income

- Cash

How did I come up with this allocation? I started by deciding how much I wanted to have in equities and worked from there. I used the rough calculation of 100 minus my age (100 - 31 = 69%) as a start. I include Trust Units as an equity component as opposed to Fixed Income as it is not fixed income in the same manner as government bonds are - trusts hold much more risk. In addition, I am low on cash which will limit my ability to purchase if the market crashes.

How did I come up with this allocation? I started by deciding how much I wanted to have in equities and worked from there. I used the rough calculation of 100 minus my age (100 - 31 = 69%) as a start. I include Trust Units as an equity component as opposed to Fixed Income as it is not fixed income in the same manner as government bonds are - trusts hold much more risk. In addition, I am low on cash which will limit my ability to purchase if the market crashes.Anyway, that is how I do it. You may do it differently. Let me know, I would love to hear your thoughts.

0 Comments:

Post a Comment

<< Home